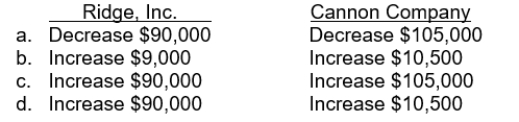

Ridge, Inc. follows IFRS for its external financial reporting, and Cannon Company follows U.S. GAAP for its external financial reporting. During 2015, both companies changed depreciation methods, from double-declining balance to straight-line. Compared to double-declining balance, for Ridge, Inc. the change resulted in a decrease in reported depreciation expense of $90,000, and for Cannon Company the change resulted in a reported decrease in depreciation expense of $105,000. The remaining useful lives of the assets impacted by the change in depreciation method is 10 years for both companies. How would this change impact the net income reported by Ridge, Inc. and Cannon Company for the year ended December 31, 2015?

Definitions:

Sales Revenue

The income received from selling goods or services, which may include discounts and deductions for returned merchandise.

High-low Method

A method applied in cost accounting that calculates variable and fixed costs by analyzing the most and least active periods.

Variable Cost

Variable cost varies directly with the level of output, including costs such as raw materials and direct labor, adjusting according to production volume.

Machine Hours

A measure of the time machines are run in the manufacturing process, used to allocate manufacturing overhead costs.

Q9: Desai Industries is analyzing an average-risk project,

Q12: Which of the following statements is CORRECT?<br>A)

Q32: Companies can recognize revenue prior to completion

Q45: Which of the following statements is CORRECT?<br>A)

Q50: Which of the following statements is CORRECT?

Q53: Which of the following statements is CORRECT?<br>A)

Q54: Mars, Inc. follows IFRS for its external

Q56: Events that occur after the December 31,

Q59: The corridor for 2015 is<br>A) $722,400.<br>B) $728,000.<br>C)

Q64: If the lease were nonrenewable, there was