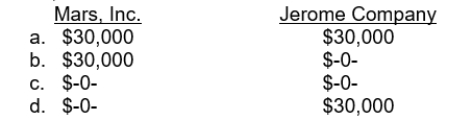

Mars, Inc. follows IFRS for its external financial reporting, while Jerome Company uses U.S. GAAP for its external financial reporting. During the year ended December 31, 2015, both companies changed from using the completed-contract method of revenue recognition for long-term construction contracts to the percentage-of-completion method. Both companies experienced an indirect effect, related to increased profit-sharing payments in 2015, of $30,000. As a result of this change, how much expense related to the profit-sharing payment must be recognized by each company on the income statement for the year ended December 31, 2015?

Definitions:

Mammary Glands

Specialized organs in mammals that produce milk to feed young offspring, predominant in female mammals.

Modified Sweat Glands

Specialized sweat glands such as mammary glands which serve additional functions beyond thermoregulation, including the secretion of milk.

Sebaceous Glands

Small oil-producing glands present in the skin of mammals, secreting sebum to lubricate skin and hair.

Testes

The male reproductive glands that produce sperm and testosterone.

Q1: The FASB requires allocations of joint, common,

Q12: Simms Corp. is considering a project that

Q13: Gibbs Company has 200 employees who are

Q16: <sup> </sup>26. At the December 31, 2014

Q27: Trade loading is a practice through which

Q36: Which of the following facts concerning plant

Q84: Because IFRS is very general in its

Q110: A pension liability is reported when<br>A) the

Q118: The accounts payable at December 31, 2015

Q126: Larsen Corporation reported $100,000 in revenues in