Use the following information for questions 94 through 98.

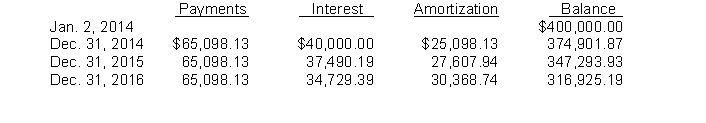

Gage Co. purchases land and constructs a service station and car wash for a total of $360,000. At January 2, 2014, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $400,000 and immediately leased from the oil company by Gage. Fair value of the land at time of the sale was $40,000. The lease is a 10-year, noncancelable lease. Gage uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Gage at termination of the lease. A partial amortization schedule for this lease is as follows:

-From the viewpoint of the lessor, what type of lease is involved above?

Definitions:

SEDAR

An online system used in Canada for the filing and retrieval of documents related to the securities industry, similar to the SEC's EDGAR system in the United States.

Insider Trade

The buying or selling of a company's securities by someone with access to confidential or non-public information about the company.

Dramatic Departure

A term that signifies a significant shift or change from the usual, expected, or traditional course, often implying dramatic or consequential actions.

Q14: Tuttle Enterprises is considering a project that

Q21: Which of the following is true regarding

Q29: Which of the following is not considered

Q35: Investments in debt securities should be recorded

Q45: Haystack, Inc. owns 30% of the outstanding

Q47: Link's income statement for the year ended

Q58: McCall Manufacturing has a WACC of 10%.

Q67: Which of the following is false with

Q112: On January 1, 2015, Shaw Co. sold

Q118: The board of directors of Ogle Construction