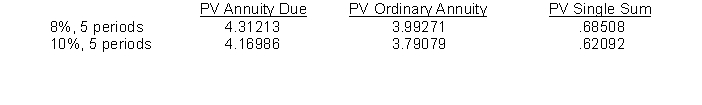

Haystack, Inc. manufactures machinery used in the mining industry. On January 2, 2015 it leased equipment with a cost of $320,000 to Silver Point Co. The 5-year lease calls for a 10% down payment and equal annual payments at the end of each year. The equipment has an expected useful life of 5 years. Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method. The selling price of the equipment is $520,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co. What is the amount of interest expense recorded by Silver Point Co. for the year ended December 31, 2015?

Definitions:

Bank CEO

The chief executive officer of a banking institution, responsible for the strategic direction and management of the bank.

Creative Way

An innovative or original approach to solving problems or generating new ideas.

Save Bank

A strategy or plan to conserve financial resources or prevent financial collapse.

Laying Anyone Off

The process of terminating employees due to business reasons such as cost-cutting, downsizing, or restructuring, rather than individual performance issues.

Q5: Peavy's net cash provided by investing activities

Q25: Fernando Designs is considering a project that

Q40: Errors and irregularities are defined as

Q49: Logan Corp., a company whose stock

Q56: Events that occur after the December 31,

Q63: Gains and losses that relate to the

Q85: High-quality standards in an international environment include

Q92: All cash dividends received by an investor

Q117: Pye Company leased equipment to the Polan

Q133: When a company amends its defined benefit