Use the following information for questions 94 through 98.

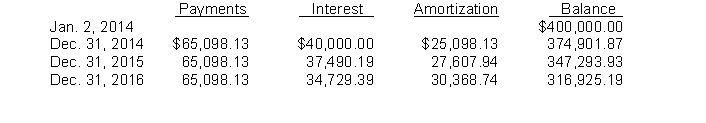

Gage Co. purchases land and constructs a service station and car wash for a total of $360,000. At January 2, 2014, when construction is completed, the facility and land on which it was constructed are sold to a major oil company for $400,000 and immediately leased from the oil company by Gage. Fair value of the land at time of the sale was $40,000. The lease is a 10-year, noncancelable lease. Gage uses straight-line depreciation for its other various business holdings. The economic life of the facility is 15 years with zero salvage value. Title to the facility and land will pass to Gage at termination of the lease. A partial amortization schedule for this lease is as follows:

-From the viewpoint of the lessor, what type of lease is involved above?

Definitions:

Prereflective

Refers to a cognitive state or process that occurs without conscious awareness or reflection.

Quasi-reflective

A stage of cognitive development where individuals recognize that knowledge may not always be certain but still rely heavily on their own opinions and experiences.

Semi-reflective

A surface or material that partially reflects light, not fully mirror-like but not completely matte either.

Reflective

Characterized by deep thought or careful consideration.

Q17: Green Construction Co. has consistently used the

Q28: The main purpose of the Pension Benefit

Q28: Ferguson Company has the following cumulative taxable

Q45: Yancey, Inc. would record depreciation expense on

Q54: At December 31, 2015, the following

Q78: The FASB believes that the deferred tax

Q80: Prior service cost is amortized on a<br>A)

Q82: The net cash provided by operating activities

Q85: The total lease-related income recognized by the

Q87: In selecting an accounting method for a