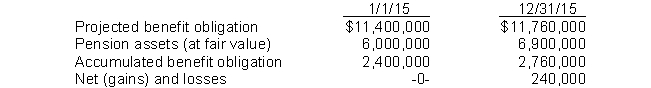

Hubbard, Inc. received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2015.  The service cost component of pension expense for 2015 is $890,000 and the amortization of prior service cost due to an increase in benefits is $180,000. The settlement rate is 10% and the expected rate of return is 8%. What is the amount of pension expense for 2015?

The service cost component of pension expense for 2015 is $890,000 and the amortization of prior service cost due to an increase in benefits is $180,000. The settlement rate is 10% and the expected rate of return is 8%. What is the amount of pension expense for 2015?

Definitions:

Non-Monetary Benefits

Advantages or perks associated with a job or situation that are not in the form of money, such as health insurance or flexible working hours.

Hotelling Rule

A theory in economics that states the net price (price minus extraction costs) of a non-renewable resource should increase at the rate of interest over time.

Exhaustible Resource

A natural resource that can be depleted and is not replenished over a short geological time frame.

Discount Rate

The discount rate is the interest rate used in discounted cash flow analysis to determine the present value of future cash flows, reflecting the time value of money and risk.

Q3: Uncertain tax positions<br>I.Are positions for which the

Q10: According to the FASB, recognition of a

Q27: Detailed guidance regarding the accounting and reporting

Q32: Deductible amounts cause taxable income to be

Q33: The estimated life of a building that

Q68: Crane, Inc. is a retailer of home

Q70: What should be the gain on sale

Q118: In all pension plans, the accounting include

Q130: The actuarial gains or losses that result

Q143: Cash receipts from customers are computed by