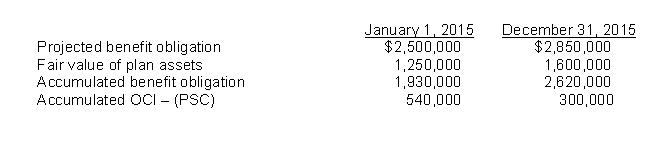

Kessler, Inc. received the following information from its pension plan trustee concerning the operation of the company's defined-benefit pension plan for the year ended December 31, 2015:  The service cost component for 2015 is $140,000 and the amortization of prior service cost is $240,000. The company's actual funding of the plan in 2015 amounted to $500,000. The expected return on plan assets and the settlement rate were both 8%.

The service cost component for 2015 is $140,000 and the amortization of prior service cost is $240,000. The company's actual funding of the plan in 2015 amounted to $500,000. The expected return on plan assets and the settlement rate were both 8%.

Instructions

(a) Determine the pension expense to be reported in 2015.

(b) Prepare the journal entry to record pension expense and the employers' contribution to the pension plan in 2015.

Definitions:

Prescribed Medications

Medicines that are ordered by a physician or other licensed healthcare professional as part of a treatment plan for a specific health issue or condition.

Selective-serotonin-reuptake-inhibitors

A class of drugs commonly used to treat depression by increasing levels of serotonin in the brain.

Depression

An emotional health problem characterized by continuous sorrow or disinterest in normal pursuits, drastically affecting the flow of daily activities.

Tardive Dyskinesia

A neurological syndrome characterized by repetitive, involuntary movements, often as a side effect of long-term use of antipsychotic medications.

Q3: On June 30, 2015, Falk Co. sold

Q38: A benefit of leasing to the lessor

Q52: If preferred stock is cumulative and no

Q63: Gains and losses that relate to the

Q81: Companies classify some cash flows relating to

Q84: If expenses, other than the cost of

Q98: A deferred tax asset represents the increase

Q103: Eubank Company, as lessee, enters into a

Q124: Wave, Inc. follows IFRS for its external

Q145: Under the cost-recovery method, a company recognizes