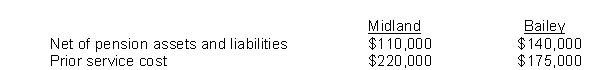

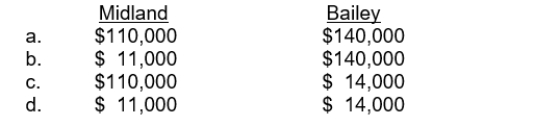

Midland Company follows U.S. GAAP for its external financial reporting whereas Bailey Company follows IFRS for its external financial reporting. The remaining service lives of employees at both firms is estimated to be 10 years. The following information is available for each company at December 31, 2015 related to their respective defined-benefit pension plans.  What is the amount of Pension Asset/Liability recognized by each company in its balance sheet at December 31, 2015?

What is the amount of Pension Asset/Liability recognized by each company in its balance sheet at December 31, 2015?

Definitions:

Taxable Event

A financial transaction that may result in taxes owing to the government.

Short-term Capital Gain

A profit realized from the sale of an asset held for less than a year, often taxed at a different rate than long-term capital gains.

Long-term Capital Gain

Profit from the sale of an asset held for more than a year, typically subject to a lower tax rate.

Mutual Fund Prospectus

A legal document provided by mutual funds to potential investors, detailing the fund's objectives, risks, performance, and expenses.

Q8: Weiser Corp. on January 1, 2012, granted

Q27: Crabbe Company reported $80,000 of selling and

Q31: What amount of compensation expense should Korsak

Q58: Equipment was purchased at the beginning of

Q87: Dyke Company's net incomes for the past

Q112: What amount should be reported in its

Q113: Midland Company follows U.S. GAAP for its

Q116: The FASB concluded that if a company

Q133: Preferred dividends are subtracted from net income

Q136: If an employee forfeits a stock option