Use the following information for questions 52 and 53.

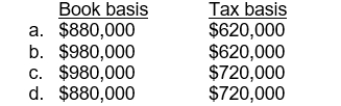

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

-At the end of 2015, what are the book basis and the tax basis of the asset?

Definitions:

Stress Interview

A technique used in interviewing to observe a candidate's response to pressure by posing stressful or confrontational questions.

Structured Interview

An interviewing technique where all candidates are asked the same predetermined set of questions to ensure fairness and consistency.

Appearance Traits

Physical characteristics or attributes of an individual that are observable.

Professional-Looking Shoes

Footwear that is suitable for a workplace environment, typically characterized by a polished and formal appearance.

Q1: On December 31, 2016, 25,000 SARs are

Q5: An individual deferred tax asset or liability

Q35: Companies account for a change in depreciation

Q63: From the lessee's viewpoint, what type of

Q71: Ben, Inc. follows U.S. GAAP for its

Q72: Changes in the fair value of a

Q80: Prior service cost is amortized on a<br>A)

Q81: On January 1, 2010, Powell Company purchased

Q98: On January 2, 2015, Mize Co. issued

Q100: Hogan Farms produced 1,600,000 pounds of cotton