Use the following information for questions 52 and 53.

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

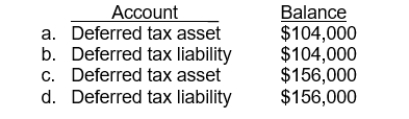

-At the end of 2015, which of the following deferred tax accounts and balances is reported on Pitman's balance sheet?

Definitions:

Net Realizable Value

The estimated selling price of goods, minus the cost of their sale or completion and any necessary disposal expenses.

Allowance for Doubtful Accounts

A concession for estimated bad debts that will arise from accounts receivable that may not be collectible.

Bad Debt Expense

An accounting term referring to the recognition of unrecoverable amounts owed to a company by debtors, treated as a cost on the income statement.

Sales Discount

A reduction in the price of goods or services offered to customers, typically to prompt early payment or boost sales.

Q15: Prepare the necessary entries from 1/1/14-2/1/16 for

Q20: Which of the following is not a

Q25: Ziegler Corporation purchased 25,000 shares of common

Q57: When a company adopts a pension plan,

Q67: A company should allocate the proceeds from

Q71: The provision for a loss on an

Q80: For each of the following items, indicate

Q87: Stine Inc. had 500,000 shares of common

Q89: Companies recognize profit under the cost-recovery method

Q115: Roman Company leased equipment from Koenig Company