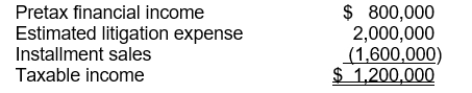

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax asset to be recognized is

Definitions:

Refrigerated Van

A refrigerated van is a vehicle designed with insulation and a cooling system to transport perishable goods at controlled temperatures.

Cryogenic Reefers Units

These are refrigeration units used for transporting perishable goods at extremely low temperatures, often utilizing liquid nitrogen or carbon dioxide as cooling agents.

ODP Rating

Ozone Depletion Potential rating; a measure of how much a chemical substance can break down ozone in the atmosphere.

Crossmember Spread

The distance between crossmembers, which are structural components that provide support and rigidity to a vehicle's chassis.

Q13: Haag Corp.'s 2015 income statement showed pretax

Q18: Surf Company follows IFRS for its external

Q28: At December 31, 2014, Hancock Company had

Q36: Joseph Co. began operations on January 1,

Q51: The Accumulated Other Comprehensive Income (G/L) account

Q67: A company should allocate the proceeds from

Q71: On November 1, 2014, Horton Company purchased

Q114: A possible source of taxable income that

Q114: Before income taxes, what amount should Rich

Q117: If Rushia Company determines that the fair