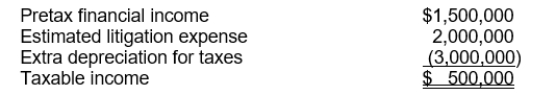

Use the following information for questions 58 through 60.

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

-The deferred tax asset to be recognized is

Definitions:

Date of Payment

The specific day on which a financial obligation must be paid, such as the date dividends are distributed to shareholders.

Dividend Payment

A financial distribution by a corporation to its shareholders, typically from the company's earnings.

Personal Taxes

Taxes levied on individuals or households by the government based on income, wealth, or consumption.

Q5: In accounting for a long-term construction-type contract

Q24: With regard to uncertain tax positions, the

Q25: Ziegler Corporation purchased 25,000 shares of common

Q27: Trade loading is a practice through which

Q96: The fair value of plan assets at

Q99: When a company sells property and then

Q112: In a statement of cash flows, what

Q112: What amount should be reported in its

Q134: A requirement for a security to be

Q138: Under the completion-of-production basis, companies recognize revenue