Use the following information for questions 58 through 60.

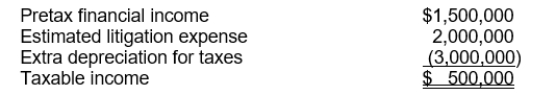

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

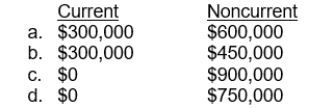

-The deferred tax liability to be recognized is

Definitions:

Stepwise Regression

A method of fitting regression models in which predictors are added or removed based on specific criteria, such as their statistical significance.

Regression Model

A statistical technique that models and approximates the relationship between a dependent and one or more independent variables.

Nonlinear Relationship

A type of relationship between two variables where a change in one variable does not lead to a constant change in the other variable.

Stepwise Regression Analysis

A method of fitting regression models where the choice of predictive variables is carried out by an automatic procedure.

Q8: The amount to be shown on the

Q15: The total effect of the errors on

Q31: Before the correction was made, and before

Q34: Revenues are realized when a company exchanges

Q41: Haystack, Inc. manufactures machinery used in the

Q45: Portugal, Inc. has the following amounts

Q67: The fair value of pension plan assets

Q91: When a change in the tax rate

Q136: Presented below is pension information for

Q146: On June 30, 2014, Yang Corporation granted