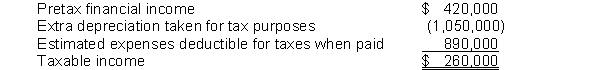

at the end of 2015, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  Use of the depreciable assets will result in taxable amounts of $350,000 in each of the next three years. The estimated litigation expenses of $890,000 will be deductible in 2018 when settlement is expected.

Use of the depreciable assets will result in taxable amounts of $350,000 in each of the next three years. The estimated litigation expenses of $890,000 will be deductible in 2018 when settlement is expected.

Instructions

(a) Prepare a schedule of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred taxes, and income taxes payable for 2015, assuming a tax rate of 40% for all years.

Definitions:

Highly Defined

Clearly outlined or specified with detailed characteristics or features.

Ambiguous

Describes something that is open to more than one interpretation, unclear, or uncertain.

Leaders Born

The belief that leadership qualities are inherent and people are born with the natural ability to lead.

Climates

Refers to the prevailing weather conditions in a geographical area over long periods, but can also relate to the general atmosphere or environment in a specific setting.

Q9: Antidilutive securities<br>A) should be included in the

Q15: Evans Construction, Inc. experienced the following construction

Q24: For which of the following products is

Q43: The date on which to measure the

Q77: If a stock dividend occurs after year-end,

Q80: For each of the following items, indicate

Q87: In selecting an accounting method for a

Q88: Employers are at risk with defined-benefit plans

Q98: A deferred tax asset represents the increase

Q126: A manufacturer of large equipment sells on