Use the following information for questions 52 and 53.

At the beginning of 2015, Pitman Co. purchased an asset for $1,200,000 with an estimated useful life of 5 years and an estimated salvage value of $100,000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Pitman Co.'s tax rate is 40% for 2015 and all future years.

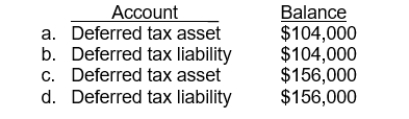

-At the end of 2015, which of the following deferred tax accounts and balances is reported on Pitman's balance sheet?

Definitions:

False Consensus Effect

The bias to overestimate the extent to which others share our beliefs, attitudes, or behaviors.

Personal Growth

The process of developing self-awareness, building personal skills, and working towards potential through personal development activities.

Genuine

Referring to honesty, authenticity, and sincerity in one’s behavior and interactions with others.

Empathic

Having the capacity to understand and share the feelings or emotional states of another person.

Q17: Differing measures of the pension obligation can

Q18: Harrison should report investment revenue for 2015

Q18: On December 31, 2014, Kessler Company granted

Q39: Munoz Corp.'s books showed pretax financial income

Q41: The following information is related to

Q45: In computing the service cost component of

Q51: When an investment in an available-for-sale security

Q61: Fryman Furniture uses the installment-sales method. No

Q65: Vested benefits<br>A) usually require a certain minimum

Q114: In computing diluted earnings per share, stock