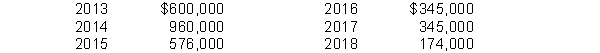

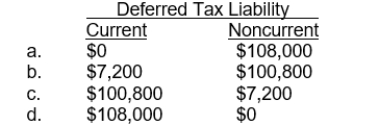

Lehman Corporation purchased a machine on January 2, 2013, for $3,000,000. The machine has an estimated 5-year life with no salvage value. The straight-line method of depreciation is being used for financial statement purposes and the following MACRS amounts will be deducted for tax purposes:  Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's balance sheet at December 31, 2014 be

Definitions:

Operant Conditioning

A learning process through which the strength of a behavior is modified by reinforcement or punishment.

Classical Conditioning

A learning process that occurs through associations between an environmental stimulus and a naturally occurring stimulus.

Magnetic Fields

Invisible fields that exert force on objects possessing a magnetic moment, including ferromagnetic materials and moving electric charges.

Loggerhead Turtles

Marine turtles known for their large heads and powerful jaw muscles, which are listed as an endangered species under threat from habitat loss and bycatch in fishing gear.

Q17: Green Construction Co. has consistently used the

Q20: Finley Company sells office equipment. On January

Q27: Trade loading is a practice through which

Q49: Companies that attempt to exploit inefficiencies in

Q53: Companies recognize the gain or loss on

Q81: A temporary difference arises when a revenue

Q83: The FASB agrees with the capitalization approach

Q90: Under the completed-contract method<br>A) revenue, cost, and

Q112: On January 1, 2015, Shaw Co. sold

Q126: Under the intrinsic value method, compensation expense