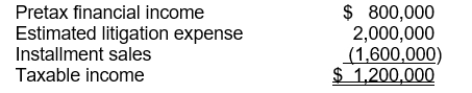

Use the following information for questions 55 through 57.

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

-The income tax expense is

Definitions:

Number of Territories

The total count of distinct territorial areas occupied or controlled by individuals or groups, often in the context of animal behavior.

Ecological Constraints Hypothesis

The theory suggesting that the distribution and dynamics of animal populations are limited by environmental and ecological factors.

Seychelles Warblers

A small bird species indigenous to the Seychelles Islands known for its interesting mating systems and conservation success story.

Helping Behavior

Acts performed by an individual that are intended to benefit another individual or individuals, often at a cost or risk to the helper.

Q7: During 2014, Gates Corp. started a construction

Q8: Which of the following is not a

Q18: When it is impossible to determine whether

Q20: The following information was taken from

Q69: Horner Construction Co. uses the percentage-of-completion method.

Q79: One of the disclosure requirements for a

Q83: Hummel Company purchased a put option on

Q90: In the process of conversion from the

Q101: Assuming that Moss Company uses the straight-line

Q116: The FASB concluded that if a company