Use the following information for questions 55 through 57.

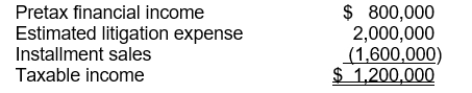

Mathis Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2016 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $800,000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $800,000 current and $800,000 noncurrent. The income tax rate is 30% for all years.

-The deferred tax liability-current to be recognized is

Definitions:

Quantitative Measures

Metrics or data points that can be quantified numerically to assess performance, trends, or changes over time.

Asset Purchases

Transactions involving the acquisition of physical or intangible assets that are expected to generate economic benefits for the business.

Capital Investment Decisions

Decisions made by businesses regarding large financial investments in projects or assets, considering future benefits and costs to maximize profitability.

Income Tax

A tax levied by the government directly on income, especially an annual tax on personal income.

Q8: Miles Co. had the following selected

Q26: Accounting for income taxes can result in

Q33: Assume that the actual return on plan

Q38: On January 1, 2014, Trent Company granted

Q39: Which of the following is not correct

Q86: Huggins Company has the following information

Q86: Which of the following differences would result

Q105: What amount of gain or loss would

Q110: What impact does a bargain purchase option

Q131: The revenue recognition principle provides that revenue