Use the following information for questions 58 through 60.

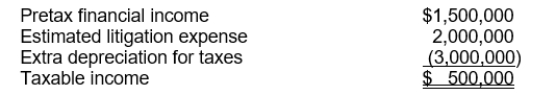

Hopkins Co. at the end of 2014, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

The estimated litigation expense of $2,000,000 will be deductible in 2015 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1,000,000 in each of the next three years. The income tax rate is 30% for all years.

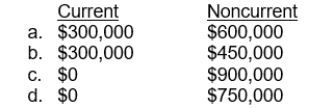

-The deferred tax liability to be recognized is

Definitions:

Electronic Media

Forms of media that require electrical or digital equipment to be accessed by the audience, including television, radio, and the internet.

Rework the Balance

The process of adjusting or redistributing elements to achieve a more desirable or harmonious state in various contexts, including work-life balance or ecological equilibrium.

Social Reality

The sum of social constructs, beliefs, traditions, and practices accepted by a group of people as the context of their everyday life.

Creating Social Reality

The process through which media and communication practices construct and shape the perception of social norms and realities.

Q17: If an FASB standard creates a new

Q31: What amount of compensation expense should Korsak

Q31: Which of the following statement is true?<br>A)

Q38: When investments in debt securities are purchased

Q57: Taxable temporary differences will result in taxable

Q69: Fultz Company had 300,000 shares of common

Q70: What is the discount rate implicit in

Q87: On December 31, 2015, Haden Corp. sold

Q91: On July 4, 2014, Chen Company issued

Q126: Larsen Corporation reported $100,000 in revenues in