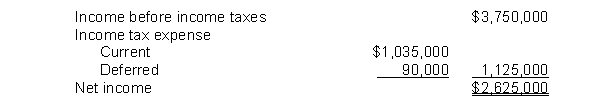

Eckert Corporation's partial income statement after its first year of operations is as follows:  Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Eckert uses the straight-line method of depreciation for financial reporting purposes and accelerated depreciation for tax purposes. The amount charged to depreciation expense on its books this year was $2,400,000. No other differences existed between book income and taxable income except for the amount of depreciation. Assuming a 30% tax rate, what amount was deducted for depreciation on the corporation's tax return for the current year?

Definitions:

Input Demand Curves

Graphs showing the relationship between the price of inputs and the quantity of inputs demanded by producers.

Marginal Product

The elevation in production output stemming from the addition of one unit of input.

Profit Maximization

The process or strategy where a firm adjusts its production to achieve the highest possible profit.

Capital

Financial assets or the financial value of assets, such as funds held in deposit accounts, as well as the physical factors of production including machinery, buildings, and land.

Q8: Weiser Corp. on January 1, 2012, granted

Q34: On December 31, 2014, Harris Co. leased

Q46: When a company decides to switch from

Q74: On the statement of cash flows (indirect

Q86: Explain the procedures used by the lessee

Q95: Houser Appliances accounts for all sales of

Q102: Which of the following is false regarding

Q111: Companies must recognize the entire expected loss

Q116: On December 31, 2014, Houser Company granted

Q136: Under IFRS, both the investor and the