Use the following information for questions 76-78.

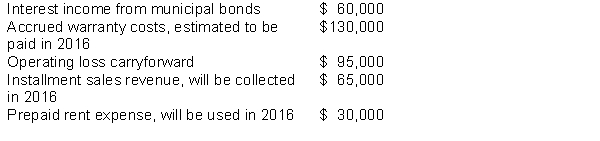

At the beginning of 2015; Elephant, Inc. had a deferred tax asset of $10,000 and a deferred tax liability of $15,000. Pre-tax accounting income for 2015 was $750,000 and the enacted tax rate is 40%. The following items are included in Elephant's pre-tax income:

-Which of the following is required to adjust Elephant, Inc.'s deferred tax asset to its correct balance at December 31, 2015?

Definitions:

Nitrogen

A colorless, odorless, tasteless gas that is the most abundant element in Earth's atmosphere, essential for plant and animal life.

Atmosphere

The layer of gases surrounding a planet, crucial for supporting life on Earth, composed mainly of nitrogen, oxygen, argon, and carbon dioxide.

Fossil Fuels

Naturally occurring carbon-based fuels derived from the decomposed remains of ancient plants and animals, such as coal, oil, and natural gas.

Energy Pyramid

For an ecosystem, a graphic depicting the energy that flows through each trophic level in a given interval.

Q15: The balance of the projected benefit obligation

Q21: Which of the following temporary differences results

Q67: On January 2, 2014, Gold Star Leasing

Q78: Benefits under a pension plan can include

Q81: A temporary difference arises when a revenue

Q86: On February 1, 2014, Marsh Contractors agreed

Q95: In accounting for a defined-benefit pension plan<br>A)

Q109: Which of the following methods to account

Q111: A major distinction between temporary and permanent

Q122: Newton Co. had installment sales of $1,000,000