Use the following information for questions 79 and 80.

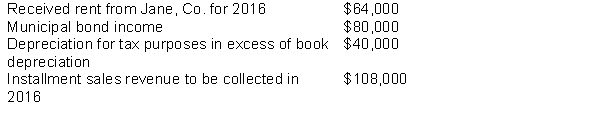

Rowen, Inc. had pre-tax accounting income of $1,800,000 and a tax rate of 40% in 2015, its first year of operations. During 2015 the company had the following transactions:

-For 2015, what is the amount of income taxes payable for Rowen, Inc?

Definitions:

Suspect Trait

A characteristic or feature in a person that may cause them to be viewed with suspicion or as a potential culprit in a criminal investigation.

Compelling Government Interest

A test of constitutionality that requires the government to have compelling reasons for passing any law that restricts fundamental rights, such as free speech, or distinguishes between people based on a suspect trait.

Federal Form

A standardized document required by a federal agency for specific purposes.

Sovereign Power

The ultimate authority of a state to govern itself or another state, including making and enforcing laws.

Q5: Which of the following items should be

Q8: Weiser Corp. on January 1, 2012, granted

Q10: According to the FASB, recognition of a

Q26: In its 2015 income statement, what amount

Q44: Which of the following disclosures is required

Q54: At December 31, 2015, the following

Q108: Korman Company has the following securities in

Q119: Sutton Company sells plasma-screen televisions on an

Q139: Tracy should report investment revenue for 2015

Q151: What effect will the acquisition of treasury