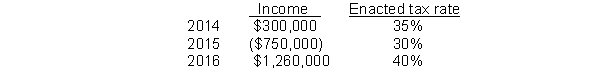

Use the following information for questions 93 and 94.

Operating income and tax rates for C.J. Company's first three years of operations were as

follows:

-Assuming that C.J. Company opts to carryback its 2015 NOL, what is the amount of income taxes payable at December 31, 2016?

Definitions:

Hydraulic Car Smasher

A heavy-duty machine designed to crush cars into compact sizes using hydraulic pressure for purposes of recycling or disposal.

Marginal Cost

The cost incurred by producing one additional unit of a product or service.

Dispose of Cars

The process of getting rid of old or unwanted vehicles through methods such as selling, recycling, or scrapping.

Production Function

A mathematical representation that describes the relationship between input factors of production (like capital and labor) and the output of goods or services.

Q23: Which of the following are considered equity

Q40: If the lease in a sale-leaseback transaction

Q49: Surf Company follows IFRS for its

Q70: What is the discount rate implicit in

Q74: IFRS requires lesses to.use their incremental rate,

Q75: Khan, Inc. reports a taxable and financial

Q91: A lessee records interest expense in both

Q98: When a company amends a pension plan,

Q108: All of the following are procedures for

Q133: When a company amends its defined benefit