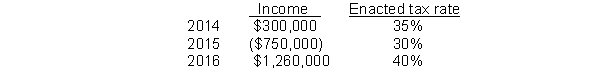

Use the following information for questions 93 and 94.

Operating income and tax rates for C.J. Company's first three years of operations were as

follows:

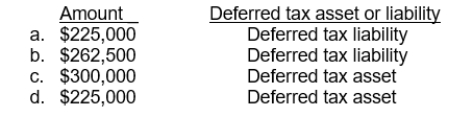

-Assuming that C.J. Company opts only to carryforward its 2015 NOL, what is the amount of deferred tax asset or liability that C.J. Company would report on its December 31, 2015 balance sheet?

Definitions:

Lumbar Nerves

A group of spinal nerves emanating from the lumbar region of the backbone, involved in movement and sensation in the lower parts of the body.

Spinal Cord

The main pathway for the transmission of information between the brain and the rest of the body, enclosed within the vertebral column.

Long-lasting Effect

A durable impact or outcome that remains over a long period of time, often beyond the expected or typical duration.

Pituitary Gland

An endocrine gland located below the hypothalamus; secretes several hormones that influence a wide range of physiological processes.

Q2: Deferred gross profit is generally treated as

Q5: Which of the following items should be

Q19: Deferred tax amounts that are related to

Q80: Companies should consider both positive and negative

Q82: Define temporary differences, future taxable amounts, and

Q83: Fugate Company had 900,000 shares of common

Q114: A possible source of taxable income that

Q127: The SEC makes it mandatory for companies

Q138: Under the completion-of-production basis, companies recognize revenue

Q158: What should be the amount of the