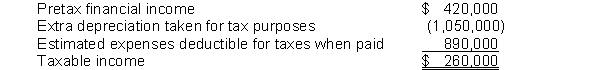

at the end of 2015, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  Use of the depreciable assets will result in taxable amounts of $350,000 in each of the next three years. The estimated litigation expenses of $890,000 will be deductible in 2018 when settlement is expected.

Use of the depreciable assets will result in taxable amounts of $350,000 in each of the next three years. The estimated litigation expenses of $890,000 will be deductible in 2018 when settlement is expected.

Instructions

(a) Prepare a schedule of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred taxes, and income taxes payable for 2015, assuming a tax rate of 40% for all years.

Definitions:

Public Opinion

The collective attitudes, beliefs, or views of the adult population regarding issues or subjects of public interest.

Agents of Political Socialization

Individuals, institutions, and experiences that contribute to and influence the political beliefs and values of individuals, such as family, schools, and media.

Populism

A political approach that strives to appeal to ordinary people who feel that their concerns are disregarded by established elite groups.

Communitarianism

A social philosophy emphasizing the importance of community in the functioning of political life, often valuing community goals over individual ones.

Q10: On January 1, 2012, Neal Corporation acquired

Q22: For calendar year 2014, Kane Corp. reported

Q44: Wynne Inc. charges an initial franchise fee

Q60: The joint project of the Financial Accounting

Q63: From the lessee's viewpoint, what type of

Q65: Under the installment-sales method, companies defer revenue

Q86: Huggins Company has the following information

Q116: The FASB concluded that if a company

Q130: The actuarial gains or losses that result

Q147: A company should report per share amounts