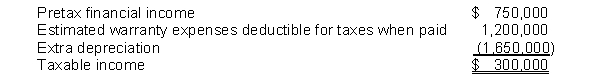

at the end of 2015, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:  Estimated warranty expense of $800,000 will be deductible in 2016, $300,000 in 2017, and $100,000 in 2018. The use of the depreciable assets will result in taxable amounts of $550,000 in each of the next three years.

Estimated warranty expense of $800,000 will be deductible in 2016, $300,000 in 2017, and $100,000 in 2018. The use of the depreciable assets will result in taxable amounts of $550,000 in each of the next three years.

Instructions

(a) Prepare a table of future taxable and deductible amounts.

(b) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2015, assuming an income tax rate of 40% for all years.

Definitions:

Health Problems

refer to any condition that affects an individual's physical or mental well-being, ranging from minor to serious conditions.

Myelinization

The process of coating the axons of neurons with myelin, a fatty substance that speeds up signal transmission.

Electrical Impulses

Rapid signals transmitted along neurons, essential for the functioning of the nervous system and communication within the body.

Temporal Lobes

Brain regions located at the sides of the brain, involved in processing auditory information, memory, and integrating sensory input with emotions.

Q5: Minimum rental payments are the same as

Q13: Companies should recognize revenue when it is

Q32: Under the fair value method, companies compute

Q37: Horner Corporation has a deferred tax asset

Q47: Myers Company acquired a 60% interest in

Q58: Nolte Co. has 4,500,000 shares of common

Q67: Watson Corporation prepared the following reconciliation for

Q111: A major distinction between temporary and permanent

Q113: How should earned but unbilled revenues at

Q142: Any given transaction may affect a statement