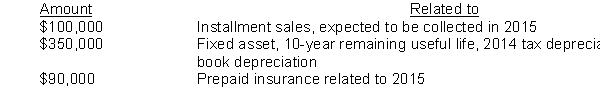

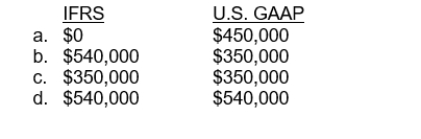

Jerome Co. has the following deferred tax liabilities at December 31, 2014:  What amount would Jerome Co. report as a noncurrent deferred tax liability under IFRS and under U.S. GAAP?

What amount would Jerome Co. report as a noncurrent deferred tax liability under IFRS and under U.S. GAAP?

Definitions:

Annuity

A financial instrument that provides a consistent flow of payments to a person, mainly serving as a source of income for people in retirement.

Equal Cash Flow

A scenario in which cash inflows or outflows are the same in each period.

Internal Rate of Return Method

A capital budgeting method that calculates the return on investment by setting the net present value of cash flows equal to zero.

Present Value

Today's worth of a forthcoming sum of money or series of cash payments, considering a designated rate of return.

Q3: Dot Point, Inc. is a retailer of

Q6: In its 2015 income statement, what amount

Q23: Which of the following are considered equity

Q95: A variable-interest entity has<br>A) insufficient equity investment

Q96: Which of the following describes a change

Q108: The unexpected gain or loss on plan

Q109: Lucas, Inc. enters into a lease agreement

Q119: Sutton Company sells plasma-screen televisions on an

Q138: Koehn Corporation accounts for its investment in

Q148: Marsh Co. had 2,400,000 shares of common