Use the following information for questions 65-68:

Seasons Construction is constructing an office building under contract for Cannon Company. The contract calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014.

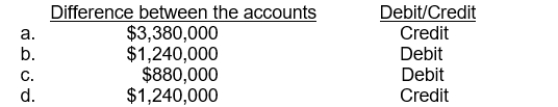

-At December 31, 2015, Seasons Construction estimates that it is 75% complete with the building; however, the estimate of total costs to be incurred has risen to $14,400,000 due to unanticipated price increases. What is reported in the balance sheet at December 31, 2015 for Seasons as the difference between the Construction in Process and the Billings on Construction in Process accounts, and is it a debit or a credit?

Definitions:

Goal Attainment

The process of achieving predetermined objectives or targets, often measured by specific criteria or milestones.

Organizational Performance

The degree to which an organization achieves its predetermined objectives, reflecting on its efficiency, effectiveness, and overall success.

Performance Effectiveness

The degree to which an individual, group, or organization meets its goals and objectives successfully.

Performance Efficiency

The degree to which an individual, team, or organization effectively achieves its goals with the minimum expenditure of resources such as time, money, and effort.

Q19: In order to properly record a direct-financing

Q24: Is the following exception applicable to IFRS

Q33: Yoder, Inc. has 150,000 shares of $10

Q38: A benefit of leasing to the lessor

Q39: Remington Construction Company uses the percentage-of-completion method.

Q72: In a contingent issue agreement, the contingent

Q81: Geary Co. leased a machine to Dains

Q91: An option to convert a convertible bond

Q109: A reconciliation of Gentry Company's pretax accounting

Q110: What impact does a bargain purchase option