Use the following information for questions 65-68:

Seasons Construction is constructing an office building under contract for Cannon Company. The contract calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014.

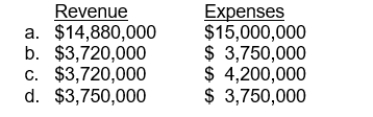

-Seasons Construction completes the remaining 25% of the building construction on December 31, 2016, as scheduled. At that time the total costs of construction are $15,000,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the year ended December 31, 2016?  The following information relates to questions 69 and 70.Cooper Construction Company had a contract starting April 2015, to construct a $18,000,000 building that is expected to be completed in September 2017, at an estimated cost of $16,500,000. At the end of 2015, the costs to date were $7,590,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $3,600,000 and the cash collected during 2015 was 2,400,000.

The following information relates to questions 69 and 70.Cooper Construction Company had a contract starting April 2015, to construct a $18,000,000 building that is expected to be completed in September 2017, at an estimated cost of $16,500,000. At the end of 2015, the costs to date were $7,590,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $3,600,000 and the cash collected during 2015 was 2,400,000.

Definitions:

Binge/Purge Subtype

A category of eating disorders characterized by cycles of excessive eating followed by efforts to avoid weight gain, such as self-induced vomiting.

Restricting Type

Refers to a subtype of anorexia nervosa characterized by severe restriction of calorie intake without engaging in binge-eating or purging behavior.

Bulimia Nervosa

An eating disorder characterized by episodes of binge eating followed by compensatory behaviors, such as vomiting or excessive exercise, due to an overconcern with body shape and weight.

Anorexia

An eating disorder characterized by an abnormally low body weight, intense fear of gaining weight, and a distorted perception of body weight or shape.

Q15: Which of the following would not be

Q16: On January 1, 2014, Janik Corp. acquired

Q29: The balance in Common Stock Dividend Distributable

Q53: Whenever a defined-benefit plan is amended and

Q78: The FASB believes that the deferred tax

Q80: If "interest payable" were credited when the

Q87: Stinson Corporation owned 30,000 shares of Matile

Q118: Jordan Company purchased ten-year, 10% bonds that

Q144: What amount would be shown in the

Q155: Companies should record stock issued for services