Use the following information for questions 65-68:

Seasons Construction is constructing an office building under contract for Cannon Company. The contract calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014.

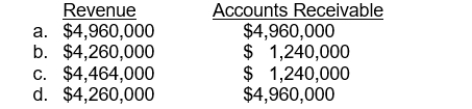

-At December 31, 2014, Seasons estimates that it is 30% complete with the construction, based on costs incurred. What is the total amount of Revenue from Long-Term Contracts recognized for 2014 and what is the balance in the Accounts Receivable account assuming Cannon Cafe has not yet made its last quarterly payment?

Definitions:

Income Tax

A tax levied by a government directly on individuals' or organizations' income.

Percentage Calculation

Percentage calculation involves determining the part of a whole in terms of 100, used in various financial and statistical contexts to express proportions.

Percentage Calculation

The mathematical process of determining the percentage amount or the percentage change between two numbers.

Percentage Calculation

The mathematical process of finding a portion of a number, represented as a fraction of 100.

Q3: In January 2014, Finley Corporation, a newly

Q10: According to the FASB, recognition of a

Q16: <sup> </sup>26. At the December 31, 2014

Q21: Which of the following temporary differences results

Q22: Treasury stock is a company's own stock

Q30: On August 1, 2014, Dambro Company acquired

Q88: Assuming that Wilcox elects to use the

Q108: The unexpected gain or loss on plan

Q126: A manufacturer of large equipment sells on

Q130: The actuarial gains or losses that result