Use the following information for questions 65-68:

Seasons Construction is constructing an office building under contract for Cannon Company. The contract calls for progress billings and payments of $1,240,000 each quarter. The total contract price is $14,880,000 and Seasons estimates total costs of $14,200,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2014.

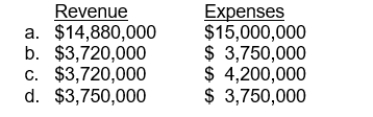

-Seasons Construction completes the remaining 25% of the building construction on December 31, 2016, as scheduled. At that time the total costs of construction are $15,000,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the year ended December 31, 2016?  The following information relates to questions 69 and 70.Cooper Construction Company had a contract starting April 2015, to construct a $18,000,000 building that is expected to be completed in September 2017, at an estimated cost of $16,500,000. At the end of 2015, the costs to date were $7,590,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $3,600,000 and the cash collected during 2015 was 2,400,000.

The following information relates to questions 69 and 70.Cooper Construction Company had a contract starting April 2015, to construct a $18,000,000 building that is expected to be completed in September 2017, at an estimated cost of $16,500,000. At the end of 2015, the costs to date were $7,590,000 and the estimated total costs to complete had not changed. The progress billings during 2015 were $3,600,000 and the cash collected during 2015 was 2,400,000.

Definitions:

Perineal Care

The practice of cleaning the genital and anal areas to prevent infection and maintain hygiene, particularly important in certain healthcare settings or after childbirth.

Seasickness

A form of motion sickness characterized by nausea, vomiting, and dizziness, typically caused by repetitive motion such as the swaying of a boat.

Gingko Biloba

A herbal supplement derived from the leaves of the Ginkgo biloba tree, used for various medicinal purposes including memory enhancement and circulation improvement.

Ginseng

A plant root often used in herbal medicine, believed to have various health benefits, including boosting energy and immune system function.

Q4: The distribution of stock rights to existing

Q38: A benefit of leasing to the lessor

Q38: Tucker, Inc. on January 1, 2015

Q42: Assume that Gomez uses the percentage-of-completion method

Q55: Computation of taxable income.The records for

Q56: Presented below is information related to

Q62: If the completed-contract method of accounting was

Q81: Grimm Company has 2,400,000 shares of common

Q106: The methods of accounting for a lease

Q120: A company reduces a deferred tax asset