Use the following information for questions 73 and 74.

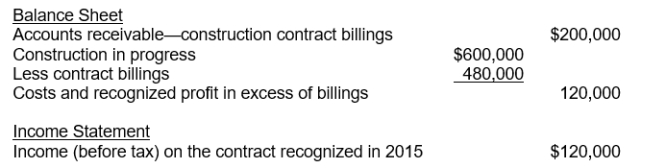

In 2015, Fargo Corporation began construction work under a three-year contract. The contract price is $4,800,000. Fargo uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2015, follow:

-What was the initial estimated total income before tax on this contract?

Definitions:

Instrumental Aggression

Aggressive behavior aimed at achieving a specific goal or objective, rather than stemming from anger or frustration.

Reinforcement

A process in psychological and behavioral science where a behavior becomes more likely to occur due to the consequences that follow it.

Territorial Defense

Territorial defense is the behavior exhibited by animals, including humans, to protect their territory from intruders or rivals.

Moyer

Roger Moyer, recognized for his contributions to understanding aggression through research on animals and humans, suggesting that aggression may serve various functions.

Q12: Taxable income is a tax accounting term

Q40: The International Accounting Standards Board has proposed

Q79: Spicer Corporation has a normal gross profit

Q82: In a defined-benefit plan, a formula is

Q86: Explain the procedures used by the lessee

Q90: In order to retain certain key executives,

Q92: An alternative available when the seller is

Q118: When a stock dividend is less than

Q119: The amount reported as the liability for

Q123: Hiser Builders, Inc. is using the