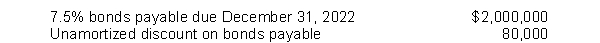

Prepare journal entries to record the following retirement. (Show computations and round to the nearest dollar.)The December 31, 2014 balance sheet of Wolfe Co. included the following items:  The bonds were issued on December 31, 2012 at 95, with interest payable on June 30 and December 31. (Use straight-line amortization.)On April 1, 2015, Wolfe retired $400,000 of these bonds at 101 plus accrued interest.

The bonds were issued on December 31, 2012 at 95, with interest payable on June 30 and December 31. (Use straight-line amortization.)On April 1, 2015, Wolfe retired $400,000 of these bonds at 101 plus accrued interest.

Definitions:

Deferred Revenues

Deferred revenues refer to money received by a business for goods or services yet to be delivered or performed, recorded as a liability on the balance sheet until the obligation is fulfilled.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term financial health and operational efficiency of a business.

Long-Term Liabilities

All of the entity’s obligations that are not classified as current liabilities.

Q18: In 2014, Bargain shop reported net income

Q19: IFRS requires that Company A consolidate Company

Q25: Under IFRS recording for the issuance of

Q33: On July 1, 2013, Noble, Inc. issued

Q42: Beaty Inc. purchased Dunbar Co. and agreed

Q89: includes one coupon in each bag

Q98: The interest rate written in the terms

Q113: Limited-life intangibles are amortized by systematic charges

Q149: In accounting for internally generated intangible assets,

Q152: Noncumulative preferred dividends in arrears<br>A) are not