Use the following information for questions 60 through 62:

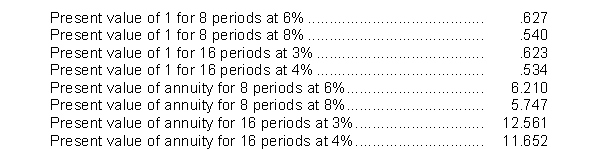

On January 1, 2014, Ellison Co. issued eight-year bonds with a face value of $4,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are:

-The issue price of the bonds is

Definitions:

Convertible Bond

A bond with an option allowing the bondholder to exchange the bond for a specified number of shares of common stock in the firm. The conversion ratio specifies the number of shares. The conversion price is the current value of the shares for which the bond may be exchanged. The conversion premium is the excess of the bond’s value over the conversion value.

Straight-Bond Value

The value of a bond calculated without considering any embedded options, based purely on its coupon payments and maturity value.

Conversion Value

The monetary value of a convertible security if it were converted into a different form, usually shares of the company's common stock.

Call Options

Financial derivatives that give the holder the right, but not the obligation, to buy an underlying asset at a predetermined price within a specific timeframe.

Q13: With regard to recognizing stock-based compensation<br>A) IFRS

Q40: Intangible assets are reported on the balance

Q42: A debt security is transferred from one

Q52: Under current accounting practice, intangible assets are

Q73: What was the effective interest rate on

Q84: An electronics store is running a promotion

Q103: Long Co. issued 100,000 shares of $10

Q114: A primary source of stockholders' equity is<br>A)

Q127: IFRS allows reversal of impairment losses when<br>A)

Q168: The following transactions involving intangible assets of