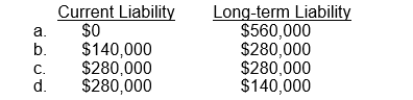

On January 1, 2012, Bacon Co. leased a building to Horner Corp. for a ten-year term at an annual rental of $140,000. At inception of the lease, Bacon received $560,000 covering the first two years' rent of $280,000 and a security deposit of $280,000. This deposit will not be returned to Horner upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the $560,000 should be shown as a current and long-term liability, respectively, in Bacon's December 31, 2012 balance sheet?

Definitions:

Charter Amendments

Changes or modifications made to a corporation’s charter or articles of incorporation, typically requiring approval from shareholders and/or regulatory authorities.

Strict Liability

A legal principle that holds a party responsible for damages or harm caused by their actions or products, without the need to prove negligence or fault.

Cash-Out Combinations

Financial arrangements, often in mergers and acquisitions, where shareholders receive cash instead of shares of the new or acquiring company.

Publicly Held Corporation

A corporation whose shares are publicly traded on a stock exchange, allowing for broad ownership by investors.

Q6: Putnam Company's 2014 financial statements contain the

Q9: Harper Company commonly issues long-term notes payable

Q42: Nolte should recognize a gain or loss

Q52: U.S. GAAP and IFRS have the same

Q69: Which of the following is not a

Q75: The new equipment should be recorded at<br>A)

Q112: At December 31, 2014, Kifer Company had

Q144: IFRS allows for reduced disclosure of contingent

Q149: In accounting for internally generated intangible assets,

Q153: Determine the fair value of liability component