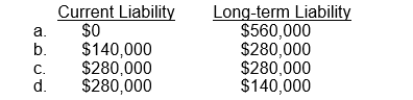

On January 1, 2012, Bacon Co. leased a building to Horner Corp. for a ten-year term at an annual rental of $140,000. At inception of the lease, Bacon received $560,000 covering the first two years' rent of $280,000 and a security deposit of $280,000. This deposit will not be returned to Horner upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the $560,000 should be shown as a current and long-term liability, respectively, in Bacon's December 31, 2012 balance sheet?

Definitions:

Liquidating Partnership

The process of terminating a partnership by selling off assets, settling debts, and distributing any remaining assets to the partners.

Capital Accounts

Refers to accounts that show the owners' or shareholders' investments in a business, including retained earnings and contributed capital.

Deficiency

A shortfall or insufficiency in amount or quantity, such as when liabilities exceed assets or when actual performance is less than the standard or expected performance.

Market Value

The existing market rate at which you can purchase or sell an asset or service.

Q9: Operating losses incurred during the start-up years

Q16: True or False.<br>Place T or F in

Q23: A company buys an oil rig for

Q30: Of the following items, the only one

Q76: Machinery which had originally cost $130,000 was

Q89: The term "depreciable base," or "depreciation base,"

Q100: A principal objection to the straight-line method

Q107: The new machine should be recorded at<br>A)

Q140: When depreciation is computed for partial periods

Q149: Written, Inc. has outstanding 600,000 shares of