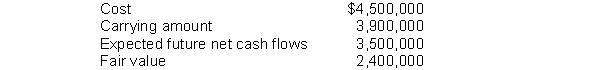

Impairment of copyrights.Presented below is information related to copyrights owned by Wamser Corporation at December 31, 2014.  Assume Wamser will continue to use this asset in the future. As of December 31, 2014, the copyrights have a remaining useful life of 5 years.

Assume Wamser will continue to use this asset in the future. As of December 31, 2014, the copyrights have a remaining useful life of 5 years.

Instructions

(a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2014.

(b) Prepare the journal entry to record amortization expense for 2015.

(c) The fair value of the copyright at December 31, 2015 is $2,500,000. Prepare the journal entry (if any) necessary to record this increase in fair value.

Definitions:

Traditional Cost System

A costing method that allocates overhead costs based on a single volume-based cost driver, such as labor hours or machine hours.

Purchase Order

A document issued by a buyer to a seller, indicating types, quantities, and agreed prices for products or services.

Batch-level Activity

Refers to tasks that are performed each time a batch is processed, affecting multiple units of product but not directly correlated to each individual unit.

Departmental Overhead Rates

Specific rates used to allocate overhead costs to products or services based on the expenses incurred by different departments.

Q20: Prepare journal entries to record the following

Q66: On January 1, 2006, Mill Corporation purchased

Q89: What were the weighted-average accumulated expenditures for

Q91: On January 1, 2014, Huber Co. sold

Q91: January 2, 2012, Koll, Inc. purchased a

Q98: A graph is set up with "yearly

Q101: In early January 2013, Lerner Corporation applied

Q118: Paying a current liability with cash will

Q120: Under what conditions is an employer required

Q127: Valley, Inc., is a retail store operating