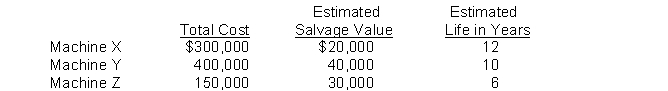

Use the following information for questions 84 and 85:

A schedule of machinery owned by Micco Co. is presented below:  Micco computes depreciation by the composite method.

Micco computes depreciation by the composite method.

-The composite life (in years) for these assets is

Definitions:

Building Expenses

Costs associated with the maintenance, repair, and running of a building.

Allocation Base

A criterion or measure used for distributing costs or expenses across different departments or products.

Building Depreciation

The systematic allocation of the cost of a building over its useful life to account for the decrease in its value over time.

Square Feet

A measurement unit for area, commonly used in real estate, equal to the area of a square with sides of one foot.

Q7: Plant assets purchased on long-term credit contracts

Q44: What factors are considered in estimating the

Q55: Which of the following statements is not

Q57: Ramos Co. purchased machinery that was installed

Q67: Ryan Distribution Co. has determined its December

Q86: Which of the following statements is correct?<br>A)

Q88: Elkins Corporation uses the perpetual inventory method.

Q96: Messersmith Company is constructing a building. Construction

Q112: The 10% bonds payable of Nixon Company

Q165: Turner Corporation acquired two inventory items at