Use the following information to answer questions 92 and 93.

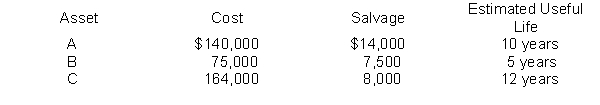

Exiter Inc. owns the following assets:

-What is the composite depreciation rate of Exiter's assets?

Definitions:

Market Value

The current price at which an asset or service can be bought or sold in an open market.

Microwave Ovens

Kitchen appliances that use microwave radiation to cook or heat food efficiently and quickly.

FIFO Method

An inventory valuation method where the first items purchased are the first ones to be sold, standing for "First In, First Out."

Ending Inventory

The total value of goods available for sale at the end of an accounting period, after accounting for purchases and sales.

Q41: Dollar-value LIFO-retail method.<br>The records of Heese Stores

Q66: Amortization of limited-life intangible assets should not

Q81: Orton Corporation, which has a calendar year

Q92: Assuming the company uses the general MACRS

Q110: Companies should accrue an estimated loss from

Q114: The recoverability test is used to determine

Q127: Ringler Corporation exchanges one plant asset for

Q153: Kesler, Inc. estimates the cost of its

Q155: Slotkin Products purchased a machine for $39,000

Q169: Leeper Corporation incurred the following costs in