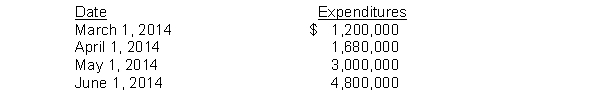

Use the following information for questions 78 through 80.

On March 1, 2014, Newton Company purchased land for an office site by paying $1,800,000 cash. Newton began construction on the office building on March 1. The following expenditures were incurred for construction:  The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

The office was completed and ready for occupancy on July 1. To help pay for construction, and purchase of land $2,400,000 was borrowed on March 1, 2014 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2014 was a $1,000,000, 12%, 6-year note payable dated January 1, 2014.

-The weighted-average accumulated expenditures on the construction project during 2014 were

Definitions:

Mirror Image Rule

A principle in contract law stating that an offer must be accepted exactly without modifications for a contract to be formed.

Parol Evidence Rule

A legal principle stating that oral agreements or statements made prior to or at the time of a written contract cannot contradict the terms of the written contract.

Merchant

An individual or company engaged in the business of selling goods or services.

UCC Article 2

Part of the Uniform Commercial Code that governs the sale of goods in the United States.

Q34: Given the historical cost of product Dominoe

Q44: Which of the following best describes the

Q47: Which of the following is not an

Q66: Which of the following best describes the

Q91: Assume the weighted-average accumulated expenditures for the

Q92: If you assume that Barton follows IFRS

Q97: Risers Inc. reported total assets of $3,200,000

Q129: If a company constructs a laboratory building

Q137: On December 31, 2014, Isle Co. has

Q162: MaBelle Corporation incurred the following costs in