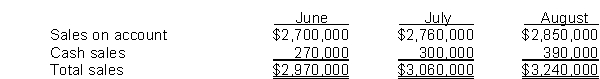

Use the following information for questions 96 and 97.

Miles Company, a wholesaler, budgeted the following sales for the indicated months:  All merchandise is marked up to sell at its invoice cost plus 25%. Merchandise inventories at the beginning of each month are at 30% of that month's projected cost of goods sold.

All merchandise is marked up to sell at its invoice cost plus 25%. Merchandise inventories at the beginning of each month are at 30% of that month's projected cost of goods sold.

-The cost of goods sold for the month of June is anticipated to be

Definitions:

Magazine Subscription

A payment made in exchange for receiving regular copies of a magazine, journal, or other periodical publication.

Payment

The transfer of money, goods, or services in exchange for a product, service, or to fulfill a legal obligation.

Depreciation

A method of accounting that distributes the expense of a physical asset across its lifespan.

Fixed Asset

Long-term tangible property that a firm owns and uses in producing its income and is not expected to be consumed or converted into cash in short-term.

Q2: Vasguez Corporation had a 1/1/14 balance in

Q16: What amount should be deposited in a

Q17: IFRS and U.S. GAAP<br>A) are diametrically opposed

Q67: IFRS permits the same depreciation methods as

Q72: At December 31, 2014, the following information

Q88: Angie invested $150,000 she received from her

Q92: If you assume that Barton follows IFRS

Q114: When using dollar-value LIFO, if the incremental

Q142: 12-131Weaver Corporation purchased Merando Company 3 years

Q157: If the contract price on a noncancelable