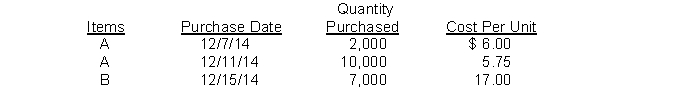

Wise Company adopted the dollar-value LIFO method on January 1, 2014, at which time its inventory consisted of 6,000 units of Item A @ $5.00 each and 3,000 units of Item B @ $16.00 each. The inventory at December 31, 2014 consisted of 12,000 units of Item A and 7,000 units of Item B. The most recent actual purchases related to these items were as follows:  Using the double-extension method, what is the price index for 2014 that should be computed by Wise Company?

Using the double-extension method, what is the price index for 2014 that should be computed by Wise Company?

Definitions:

Multinationals

Large corporations that have operations, production, or service facilities in more than one country, often playing a significant role in global trade and economic relations.

Billion-Dollar Mergers

Large-scale corporate mergers involving the combination of companies or assets with a total value of at least one billion dollars.

Financial Scandals

Instances of dishonesty or unethical behavior in the financial industry, often involving the theft of funds or manipulation of financial markets.

Corporate Merger

The combining of assets and operations of two companies to form a single entity, often with the aim of increasing market share or reducing costs.

Q22: Provide clear, concise answers for the following.<br>1.

Q44: The change in the LIFO Reserve from

Q44: Al Darby wants to withdraw $20,000 (including

Q64: Why might inventory be reported at sales

Q67: Current assets are presented in the balance

Q94: Which of the following tables would show

Q117: The floor to be used in applying

Q121: Which of the following authoritative IFRS guidance

Q132: An accountant wishes to find the present

Q156: Which of the following methods of determining