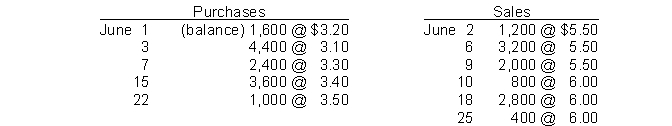

Use the following information for questions 103 through 106.

Transactions for the month of June were:

-Assuming that perpetual inventory records are kept in dollars, the ending inventory on a LIFO basis is

Definitions:

Uncollectible Accounts

Accounts receivable that a company has determined it will not be able to collect due to customer default.

Direct Write-off

A method of accounting for bad debts where uncollectible accounts receivable are directly written off against income at the time they are deemed uncollectible.

Bad Debts Recovered

When an account receivable has been written off and is recovered, this account, which is in the Other Revenue category, is credited in the direct write-off method if the recovery is in a year following the write-off.

Allowance for Doubtful Accounts

A contra asset account that estimates the portion of receivables that may not be collectible, affecting a company’s net income and assets.

Q3: Keck Co. had 150 units of product

Q30: Special assessments for local improvements such as

Q51: Unlike U.S. GAAP, interest costs incurred during

Q56: IFRS defines market as replacement cost subject

Q129: Improvements are often referred to as betterments

Q134: The percentage-of-sales method results in a more

Q147: What interest rate (the nearest percent) must

Q150: Under IFRS, the characteristics that would imply

Q151: During 2014, Corporation acquired a mineral mine

Q173: The IFRS approach for derecognizing a receivable