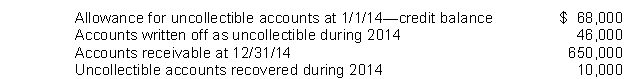

Ace Co. prepared an aging of its accounts receivable at December 31, 2014 and determined that the net realizable value of the receivables was $600,000. Additional information is available as follows:  For the year ended December 31, 2014, Ace's uncollectible accounts expense would be

For the year ended December 31, 2014, Ace's uncollectible accounts expense would be

Definitions:

Interest Rate Parity

A theory suggesting that the difference in interest rates between two countries will be equal to the differential between the forward exchange rate and the spot exchange rate.

British Security

A financial instrument issued in the UK that represents either equity in a company, debt obligations, or other rights to ownership or profit.

Forward Rate

An agreed-upon price for a financial transaction that will occur at a future date.

International Fisher Effect

A theory stating that the difference in nominal interest rates between two countries is equal to the expected change in their exchange rates.

Q7: Amortization of discount on note.<br>On December 31,

Q42: The balance sheet contributes to financial reporting

Q50: The cash debt coverage is computed by

Q68: If a company uses the periodic inventory

Q77: Given the acquisition cost of product Z

Q110: Which of the following entries would Harrison

Q129: Risers Inc. reported total assets of $1,800,000

Q144: Miller Company, a company who uses IFRS

Q147: Bell Inc. took a physical inventory at

Q168: Both U.S. GAAP and IFRS exclude which