Use the following information to answer Questions 7 and 8.

Johnstone Company has a loan receivable with a carrying value of $125,000 at December 31, 2013. On January 1, 2014, the borrower, Ralph Young Industries, declares bankruptcy, and Johnstone estimates that it will collect only 45% of the loan balance.

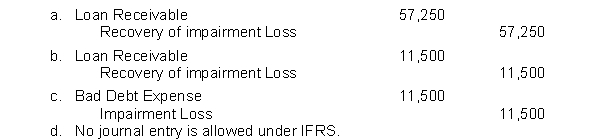

-Assume that on January 4, 2015, Johnstone learns that Ralph Young Industries has emerged from bankruptcy. As a result, Johnstone now estimates that all but $11,500 will be paid on the loan. Under IFRS, which of the following entries would be made on January 4, 2015?

Definitions:

Opportunity Costs

The price paid for not selecting the immediate alternative choice during decision-making.

Collection Float

The time period between when a check is deposited into a bank account and when the funds are available for use, affecting the cash flow of a business.

Net Float

The difference between checks written against a checking account and those that have been cleared by the bank.

Net Collection Float

The net collection float is the time difference between when a check is deposited into a bank account and when the funds become available for use, essentially measuring the delay in bank processing.

Q35: What is the normal journal entry for

Q39: White Corporation uses the FIFO method for

Q47: IFRS does not intend to issue detailed

Q57: Balance sheet presentation.Given the following account information

Q64: Factors that shape an accounting information system

Q72: Which of the following statements is correct

Q82: The cash account shows a balance of

Q84: June Corp. sells one product and uses

Q95: Discontinued operations of a component of a

Q117: Mordica Company will receive $300,000 in 7