Calculation of unknown rent and interest.

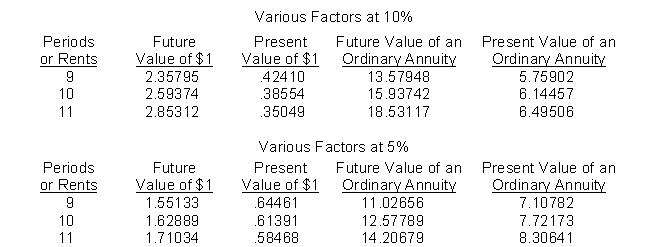

Pine Leasing Company purchased specialized equipment from Wayne Company on December 31, 2013 for $800,000. On the same date, it leased this equipment to Sears Company for 5 years, the useful life of the equipment. The lease payments begin January 1, 2014 and are made every 6 months until July 1, 2018. Pine Leasing wants to earn 10% annually on its investment.

Instructions

(a) Calculate the amount of each rent.

(b) How much interest revenue will Pine earn in 2014?

Definitions:

Q4: The following information applied to Howe, Inc.

Q22: Provide clear, concise answers for the following.<br>1.

Q25: An accrued expense can best be described

Q35: Free cash flow is calculated as net

Q49: Income statement disclosures.What is disclosed in an

Q88: The primary purpose of a statement of

Q89: Which of the following is included in

Q92: If you assume that Barton follows IFRS

Q99: Liquidity refers to the ability of an

Q131: Which table would show the largest factor