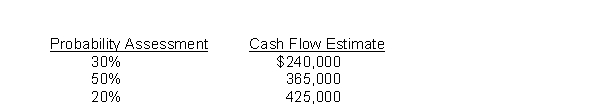

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company. The trade name has a book value of $1,800,000, but according to IFRS, it is assessed for impairment on an annual basis. To perform this impairment test, Reegan must estimate the fair value of the trade name. It has developed the following cash flow estimates related to the trade name based on internal information. Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years. The trade name is assumed to have no residual value after the 7 years. (Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%. To the nearest dollar, what is the estimated fair value of the trade name?

Definitions:

Relationship Building

The process of establishing and maintaining positive connections with others, often characterized by trust, understanding, and cooperation.

Objective Attainment

The process or strategy employed to achieve specific goals or targets set by an individual or organization.

Management By Objectives (MBO)

A strategic management model where objectives are defined by managers and employees to ensure that everyone is working towards common goals.

Subordinates

Employees or team members who are in a lower position or rank than others and typically report to a supervisor or manager.

Q54: LIFO is inappropriate where unit costs tend

Q66: Norling Corporation reports the following information: <img

Q81: If a savings account pays interest at

Q96: IFRS and U.S. IFRS are very similar

Q105: Under what circumstances should a company with

Q107: Which of the following recording procedures would

Q113: A soundly developed conceptual framework enables the

Q126: Which of the following is false?<br>A) The

Q151: Assume that the proper correcting entries were

Q152: Assuming the market interest rate is 10%