Calculation of unknown rent and interest.

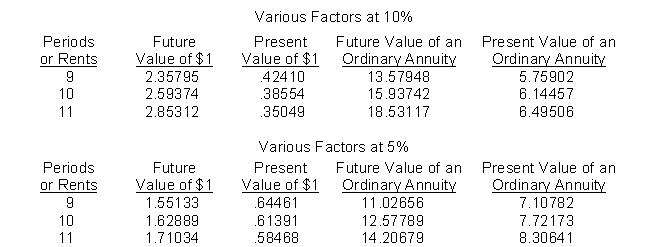

Pine Leasing Company purchased specialized equipment from Wayne Company on December 31, 2013 for $800,000. On the same date, it leased this equipment to Sears Company for 5 years, the useful life of the equipment. The lease payments begin January 1, 2014 and are made every 6 months until July 1, 2018. Pine Leasing wants to earn 10% annually on its investment.

Instructions

(a) Calculate the amount of each rent.

(b) How much interest revenue will Pine earn in 2014?

Definitions:

Informed Consent

The process by which a healthcare provider educates a patient about the risks, benefits, and alternatives of a given procedure or intervention before the patient agrees to it.

Emancipated Minor

A person under the age of majority who is legally recognized as independent from their parents or guardians.

Competent

Having the necessary ability, knowledge, or skill to do something successfully, especially with regard to professional tasks or duties.

Nursing Standards

Established guidelines and expectations for the professional practice and behavior of nurses to ensure quality and consistency in nursing care.

Q37: According to Statement of Financial Accounting Concepts

Q41: For Mortenson Company, the following information is

Q42: Present value is<br>A) The value now of

Q51: Which of the following is not a

Q75: Jenny Manufactures sold toys listed at $240

Q80: Both U.S. GAAP and IFRS permit the

Q83: Which of the following entries would Johnstone

Q106: Trade discounts are<br>A) not recorded in the

Q107: When a customer purchases merchandise inventory from

Q115: Define current assets without using the word