Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

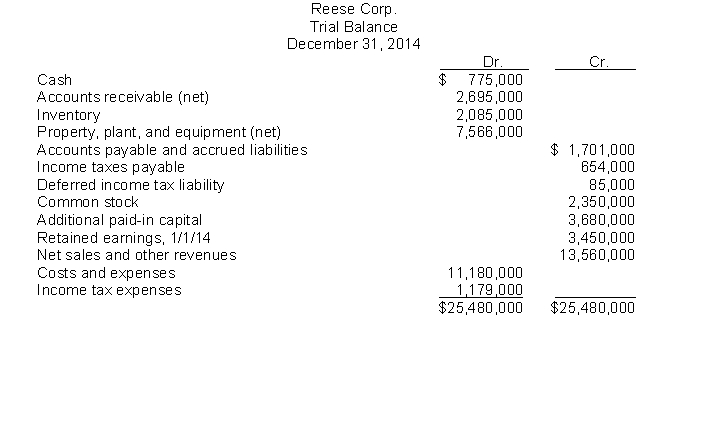

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current assets total is

Definitions:

Forest Ranger

A forest ranger is a professional responsible for the protection and preservation of forests, supervising activities within forested areas to ensure the health of the forest ecosystem.

Forest Fire

An uncontrolled fire that occurs in wilderness or rural areas, potentially causing extensive damage to ecosystems.

Perceptual Set

A mental predisposition to perceive one thing and not another, influenced by expectations, emotions, and culture.

Loch Ness Monster

A mythical creature said to inhabit Loch Ness in the Scottish Highlands, often described as large, long-necked, and with one or more humps protruding from the water.

Q37: Jim Yount, M.D., keeps his accounting records

Q39: Houghton Company has the following items: common

Q59: Which table has a factor of 1.00000

Q64: An item that should be classified as

Q72: Which of the following facts concerning fixed

Q78: The market price of an $800,000, ten-year,

Q107: Under IFRS, the discount rate should reflect

Q111: The ending retained earnings balance is reported

Q138: Deferred annuity.<br>Carey Company owns a plot of

Q157: Under IFRS, an entity should initially recognize