Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

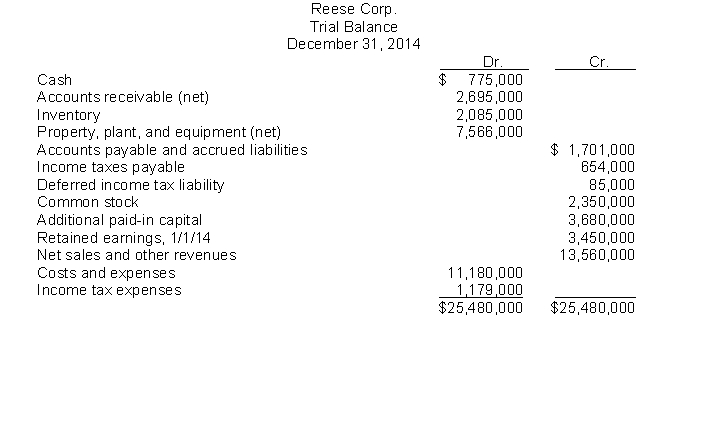

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current liabilities total is

Definitions:

Furosemide (Lasix)

A diuretic medication used to treat fluid retention and swelling caused by congestive heart failure, liver disease, or kidney disease.

Loop Diuretic

A type of medication that works on the loop of Henle in the kidney to increase urine production, commonly used to treat conditions like hypertension and edema.

Dorsal Recumbent

A body position where the individual lays on their back with legs bent and feet flat, commonly used for medical examinations or procedures.

Indwelling Urinary Catheter

A tube inserted into the bladder through the urethra to drain urine, left in place for a period of time.

Q12: A company should report a restructuring charge

Q16: Sun Inc. factors $3,000,000 of its accounts

Q21: On January 1, 2014, Lynn Company borrows

Q57: Which of the following is false about

Q66: Norling Corporation reports the following information: <img

Q67: Tresh, Inc. had the following bank reconciliation

Q72: Which of the following facts concerning fixed

Q81: Adjusting entries.Data relating to the balances of

Q114: Olsen Company paid or collected during 2014

Q151: What is the relationship between the present